Delta Options

Momentum-based options picking service

Let’s play a game…

Imagine this scenario:

I give you a coin, and I make you a proposal.

Heads — you pay me $5.

Tails — I pay you $7.

Do you play? Yes? How many times?

If you’re thinking “As many times as you’ll let me,” you’re in the minority…

Most people wouldn’t play this game. Most people can’t see beyond what they have to lose. Most people make decisions based on emotion, not logic. They can’t think in terms of asymmetric bets.

But you can.

Fortunately for you, this gap in logic creates an opportunity.

Because many investors seem to be similarly irrational.

Why momentum investing works

Emotion, not logic, moves the markets.

In a groundbreaking paper, Daniel Khaneman et al. found that stock prices frequently overreact or underreact to new information.

Of course, it isn’t the stock prices themselves that were overreacting or underreacting, but the investors who were trading them.

Investors are handicapped by two cognitive biases:

The Anchor Effect: Investors rely on the first piece of information they receive, like an initial stock price. “Anchored” to this initial number, investors tend to underweight new information. This leads investors to think things like Nvidia can’t be worth $900 per share since it was worth just $400 per share less than a year ago, regardless of how strong the underlying fundamentals.

Prospect Theory: Investors are disposed to sell their winners and hold their losers, despite obvious reasons to do the opposite (the stock price rose because it is a good stock to own). This is known as “cutting the flowers and watering the weeds.” If the fundamentals support it, Nvidia may in fact be a better investment at $900 per share than it was at $400.

Together, these two biases create a large mental hurdle investors need to overcome to hold or buy stocks whose prices have appreciated, regardless of how strong the reasons for their appreciation (such as improving fundamentals).

That’s why momentum investing works.

Since almost all investors suffer from these cognitive blindspots, the best-performing stocks are frequently undervalued by the market, leaving additional room for future price appreciation.

And therein lies our opportunity.

About Delta Options

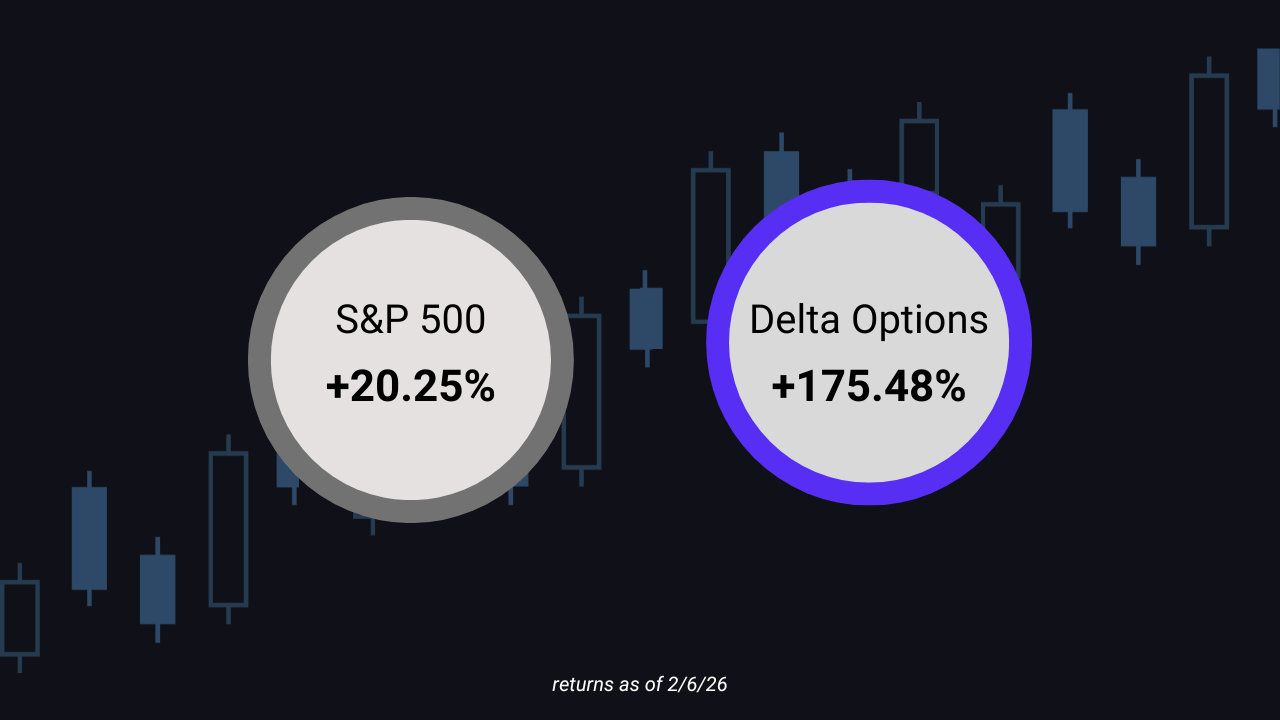

Our momentum-based strategy has returned nearly 200% since being launched in July 2022.

Over that time, we’ve added 78 picks to the portfolio.

A $1,000 investment in each of these picks would be worth over $231,000 at the time of this writing, outpacing the S&P by a wide margin:

If you’re wondering how we’ve achieved these returns, remember the coin-flipping game from above?

The power of our system also comes from asymmetric returns.

While 29 of our picks have lost money, that doesn’t really matter because:

27 of our picks have gained more than 100%,

15 of our picks have gained more than 200%,

9 of our picks have gained more than 500%, and

5 of our picks have gained more than 1,000%

We don’t expect to win every trade — far from it.

But our goal is for our winners to more than compensate for our losers, thanks to asymmetric returns.

Why you shouldn’t subscribe

Our style of investing isn’t for everybody.

There will be volatility. There will be losers.

You need a long-term view. You also need to look at the portfolio collectively, as a whole, not as many individual positions.

You also need a portfolio size of at least $100,000. We use this strategy as a “portfolio enhancer,” allocating between 5-20% of our total portfolios to this strategy (and buying every single position).

If you’re still interested, here’s what you’ll get with a subscription…

What you’ll get

A subscription to Delta Options comes with:

2 new picks per month

Research reports alongside the recommendations

Transparent access to our portfolio including all previous picks, the details of those picks, and their performance vs the S&P

You can get started with the button below: